Well, this one at least seems obvious to me

Certain numbers are seared into our minds at the moment. £1277: the old price cap. £1971: the new price cap. The difference: £693 (don’t ask). The price cap itself was the idea of an idiot, but we have had a few months of protection by it, even if the corpse pile of failed companies that resulted will be adding to the cost of energy going forward. Ofgem’s announcement was still ringing in our ears when the Chancellor boldly strode forth to slay the dragon. According to the BBC,

He says it is clear that the price rises are caused by global factors. “No British chancellor can change what is going on in Asia or stop a nuclear power plant going offline in Germany,” he says.

Rishi Sunak is adamant that there is nothing he can do about the price of energy in the UK. It is all someone else’s fault, and the best that he can do is to soften the blow by throwing some of our own money at us. He may well be right. Vasty things have a momentum of their own, and some of our troubles had their genesis before Sunak was even an MP (he was elected in 2015).

This is a brief tale of two graphs.

The first shows the net imports of natural gas to the UK from 1996 to 2021, in GWh. There was a halcyon fortnight back at the turn of the millennium, when the clocks failed, there were some fireworks, things could only get better, and the UK was a net exporter of gas. Who knows, when the history of these times is written, we might decide that the UK peaked as a civilisation at that moment. From 2004 we were net importers of gas, increasingly so until 2010, whereupon things have stabilised at about 400,000 GWh per year (turned into power, that would be about a constant 45 GW). Imports are now more than half our usage, and if our vulnerability to external events rises as the proportion we import rises, then we have never been more vulnerable to “global” factors. Or to put it another way: our Chancellor has never been more pointless.

The second graph shows the net imports of natural gas to the US from 1973 to 2021 in MMcf. These peaked in 2007… and have since plummetted. In 2017 the US became a net exporter, and hasn’t looked back, despite the change in administration.

Now, if the Chancellor is correct, and the price of gas is driven by global events over which he has no control, the price of gas ought to be the same in both countries, irrespective of whether they are net importers or net exporters, right?

Today’s price in the UK: 195.5p/therm

Today’s price in the US: $4.55/MMBtu = $0.455/therm = 33.7p/therm

Well, he’s almost right. It’s close. Only 5.8 times more expensive on this side of the pond.

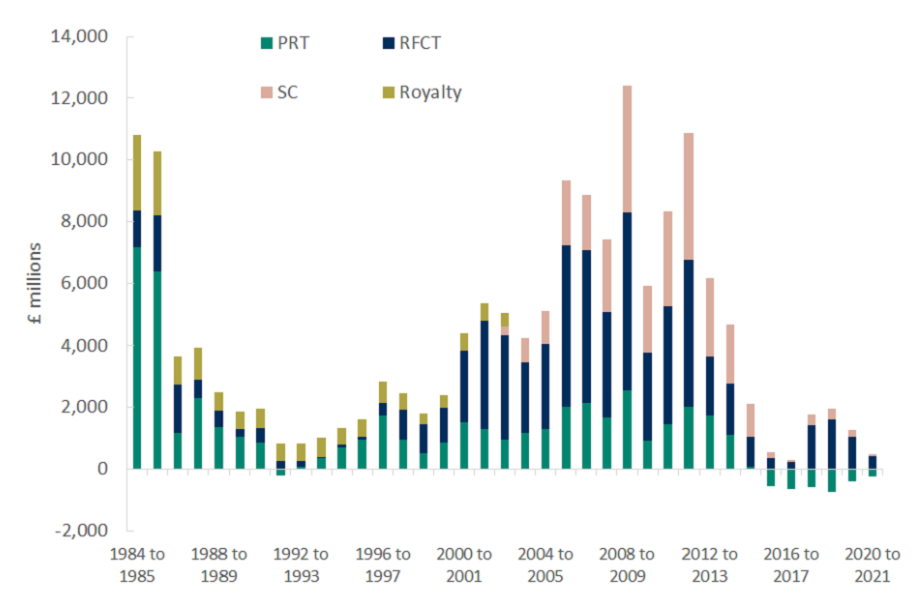

Various hindrances have been put on UK domestic production over the years. The industry was seen as a helpless cash cow, and was milked mercilessly. You might say the Treasury rather than the petro companies overexploited our oil and gas resources. In 2008/9 the amount raised for the Treasury by the oil and gas sector was over 12 billion quid – last year’s figure had dwindled to something like 200 million. (With sky-high prices, this year will presumably be a bump up, hence the absurd demands for a windfall tax.)

The North Sea has become a hostile environment for oil and gas companies. The pressure is all one way. The likes of BP have seen which way the wind is blowing (ahem) and are squandering their heritage and their cash on a gamble that subsidies will flow forever. (They might be able to make money if the cost of electricity stays at heroic levels – but if that happens, surely all bets are off.) Fracking? What’s that? Never heard of it.

Production is going down, and according to the OGUK, it may decline by 75% by 2030. At that stage, absent a decline in use, we’ll be importing 80% of our needs. Will we be more or less at the whim of global winds at that stage? The answer does seem to be obvious.

If the Russians reduce deliveries of gas to Europe, then it has to come from somewhere else, most likely as shipments of liquefied natural gas. That will increase competition for supplies, driving up prices and consumer bills even more. Conversely, any additional gas we produce ourselves will help alleviate this process. In the longer term, if UK gas production is allowed to fall as predicted, then our energy supplies will become ever more vulnerable to global events over which we have no control – as we now see happening with Russia’s threatened invasion of Ukraine.

OGUK Energy Policy Manager Will Webster

Featured image: the author’s failure to find a different obvious answer.

Bonus figure: UK gov’t revenue from the oil and gas sector.

The “zero” in “net zero” stands for “zero rationality”.

Climate policies are zero science, wrapped up in sciencey sounding words.

LikeLiked by 1 person

Jit, as always, thank you for a brilliantly clear exposition. It shouldn’t be necessary. As you say, the answer is obvious. Unfortunately, however, the lunatics have taken over the asylum.

LikeLiked by 1 person

Hello, you wrote, “In 2008/9 the amount raised for the Treasury by the oil and gas sector was over 12 billion quid”.

To put that figure in context … IIRC from OBR data recently on Paul Homewood’s NotALotOfPeopleKnowThat site then 12 billion quid is about the current levy on energy bills that is then disbursed on various green energy schemes, about half of which goes to wind farms. Ouch!

Regards,

John.

LikeLike

1 Therm = 29.3071kWh for those receiving gas bills in metric units. 😉

LikeLike

your comment “Fracking? What’s that? Never heard of it.” seems to sum up the UK Gov cr*p response to gas imports, what a balls up – would like to know who stopped “Fracking” in the UK – Seem to remember a small group stopped it dead & now we see the outcome. will the MSM report on that ?

no chance.

LikeLike

Fracking: I wish people would write about this conveying the facts. It isn’t the Greens who are blocking matters. There is no proven oil/gas bonanza that hidden actors are preventing the U.K. from participating in. Most exploration tapped the Bowland Shale in Lancashire. This showed promise but so have other organic shale formations in Europe. Poland has much more favourable prospects but AFAIK no great production. Exploration in the U.K. was halted because drilling provoked earthquake activity. Previously unknown and undetectable faulting of shale against shale was held to be responsible. Currently there is a moratorium upon drilling and fracking. To summarise: we can’t reach, let alone tap into our hypothetical hydrocarbon bonanza, and furthermore we don’t even know if it’s there.

LikeLike

Hello Alan Kendal,

I have some sympathy with your comments but I believe that they need some qualification. Yes, the UK’s geology is complex and so any fracking potential may be difficult to exploit unless the technology can be further developed to overcome the complexities which manifest themselves over short distances (cf. USA’s geology). However, the “earthquakes” of which you speak were, as I understand it, no more than a train passing some 100 metres away. That is, the legal constraints on such fracking as was undertaken were more severe than for other industries such as quarrying.

Should we not be less terrified by every potential problem and instead undertake a wide range of fracking experiments to better understand the true potential of this resource before we write it off as a damp squib? Especially as I understand that the British Geological Survey considers there to be a great deal of gas beneath our feet.

Regards,

John.

LikeLike

John Cullen. Everything you have written is correct. But what you omit is the fact that the strength of earthquakes produced by fracking was steadily increasing and when the moratorium was introduced the earthquakes produced were of a strength that they could be felt by some. The fear was that succeeding earthquakes would continue to increase in strength and would cause structural damage.

As to whether or not we should have continued; that is a subject for John Ridgway. He would need information upon the likelihood of future damaging earthquakes compared with the possibility of making a sizeable oil discovery – both impossible(?) to evaluate before drilling/fracking. I certainly would not wish to be an inhabitant near Blackpool put at possibly considerable risk.

LikeLike

Hi Alan

The unduly-pessimistic seismic limit set for fracking for shale gas (0.5 ML) is 3,162x smaller / 177,000 weaker than the magnitude (4.0) deemed to “… not cause any significant damage” when for fracking for geothermal.

The ML 2.3 fracking-induced event that rattled the enviros, and caused a cup to fall off a shelf near Blackpool is not uncommon in the UK.

https://earthquakes.bgs.ac.uk/earthquakes/recent_uk_events.html

As far as seismic events affecting Blackpool, the British Geological Survey produced this video ‘Does fracking cause earthquakes? Shale gas’:

“Only 50 people felt it, IT DID NO DAMAGE, Blackpool’s trams cause more perceptible vibrations than work on borehole”

Heavy lorries driving to wind-turbine installation sites are seismically more perceptible.

LikeLiked by 1 person

Let me ask some simple questions. Q1. Can you guarantee that if drilling and fracking were to continue that damaging earthquakes would not occur? Q2 if a damaging earthquake were to occur, who pays? Many fracked wells have to be re-stimulated, and wells drilled into organic shales, with both ductile and crushable components will definitely need refracking. Will refracking be more or less dangerous than the original frac-job (Q 3)

BTW I think that only finding frackable oil will be economic. When I worked as an oily in the 1970s/1980s the rule of thumb was that gas fields were only economic under primary production methods; only oil fields would be stimulated by fracking. So there could be scads of gas (U.K. geol. survey) but little of it might be economically produced.

Then there are the Greenies. If a viable frackable oilfield we’re to be discovered, could it be developed? (Q4). The government has already authorised development of offshore oilfields only to be met by opposition. Do you really think Quadrilla would be allowed to develop any real find? (Q4a). I wouldn’t hold my breath.

LikeLike

Alan,

Of course I will always defer to you on issues relating to geology, where yo have massive expertise, and what I know about it can be written on the back of a postage stamp.

Your opposition to fracking in Lancashire seems to me to be opposition on rational grounds, rather than of the knee-jerk reaction type from those who oppose it because it’s about oil and/or gas (i.e. fossil fuels which will emit CO2 if burned) rather than opposing fracking because it’s (allegedly) dangerous. For such people, claims about fracking being dangerous are a handy cover so they don’t have to talk about oil and gas. They never seem to oppose what’s going on at the Eden Project, for instance, which so far as I can see involves fracking for geothermal energy (i.e. what is to them good energy, therefore in that context fracking = good, not bad).

I found this from 7 or 8 years back:

https://frackland.blogspot.com/2014/06/a-tale-of-two-letters.html

“I’ve just spotted that Tim Smit, the founder of the Eden Project, Cornwall, is one of the signatories on the anti-fracking letter in the Times.

The Eden Project is currently planning an Engineered Geothermal System (EGS) to provide power and heat to the site. As any geologist will tell you, an EGS system requires “fracking” to create fractures in the granite rock to allow hot water to circulate. Or as the Eden Project describe it,

“Two boreholes, each around 25cm wide, are drilled into the rock to a depth of about 4.5km. This is done by pumping water down one borehole until the natural fractures in the rock are opened and water can flow.”

In his own words, Sir Tim believes that “there is substantial evidence showing that fracking causes water stress and risks water contamination and soil contamination, earth tremors — and is a threat to human, wildlife, bird, fish and livestock health”. I would love to know how he can think this and yet be happy for fracking to take place right next to the Eden Project.”

LikeLiked by 1 person

Exploiting all forms of energy involves risk. The fact remains that a far higher ML has been deemed acceptable for fracking for green, environmentally sound geothermal vs shale gas.

Mining for coal (and minerals / metals required for renewables’ hardware) incurs risk. By far the largest energy-related death toll was the Banqiao Dam failure – with an estimated death toll ranging from 26,000 to 240,000.

Greenies have opposed *all* forms of energy exploitation. Yet Greenies still choose to use energy. Their hypocrisy is laughable.

BGS points out that there is substantial gas-in-place for even just our Bowland Shale Formation.

https://www.bgs.ac.uk/geology-projects/shale-gas/shale-gas-in-the-uk/

See also

Click to access Estimates_of_UK_Undiscovered_Resources_July_2016_v1.pdf

LikeLike

Alan:

“Do you really think Quadrilla would be allowed to develop any real find? (Q4a). I wouldn’t hold my breath.”

I think the severity of the restrictions placed on the Quadrilla test sites were a clear signal to them not to expect permission for production drilling and possibly not to publish an optimistic report of their testing.

LikeLike

Mark. There is an enormous difference between fracking an organic rich shale (actually a mudstone) and breaking a hard and essentially uniform granite rock by overpressured water. I understand that a new Eden Project is destined for Cumbria. I would not object to fracking the Cornish granite, whereas I would have reservations about Cumbria (which might be offset), but downright opposition if geothermal fracking were to be proposed for the Bowland Shale.

You are correct my objections are based upon a genuine fear of what might happen. If you wished to avoid reactivating a fault line you would not frack rocks along it. Think of the Bowland Shale as a crushed mudstone where fault line crush zones cannot be identified, and therefore avoided, before drilling.

LikeLike

Alan, thank you as always. In one respect, though, you are incorrect. I believe the new Eden Project is planned for Morecambe – Lancashire, not Cumbria. I’m not aware that it includes plans for fracking!

LikeLike

Alan, thanks for your response –

“Fracking: I wish people would write about this conveying the facts. It isn’t the Greens who are blocking matters. There is no proven oil/gas bonanza that hidden actors are preventing the U.K. from participating in.”

I agree with you on “no proven” but that’s what the test frack sites were set up to determine (I think).

when I say “a small group stopped it dead”, it may not have been “the Greens” but a small camp of “activists” camped at any

test frack site was reported on almost every night by the TV MSM. Do you think that had no impact on Gov policy on this ?

LikeLiked by 1 person

Alan, thanks for being the voice of caution here. Many of us do get carried away with “But fracking!”

I have not read much in this area, but was under the impression that the potential volumes of gas available were quite high, and that the tremors were minor. I will have to read more.

Nevertheless, my point here was only that our government are either liars or incompetents, because it is very plain that domestic supplies do protect us from global issues – not entirely, but partly, and in proportion to our own self-sufficiency.

Speaking of which:

https://www.telegraph.co.uk/politics/2022/02/07/six-north-sea-oil-gas-fields-fired-amid-cabinet-row-net-zero/

LikeLiked by 3 people

JIT

“…was under the impression that the potential volumes of gas available were quite high, and that the tremors were minor”.

Quite right. The UKGS are bullish but only one exploration company has followed their lead. There could be significant hydrocarbons but AFAIK no one has fracked significant amounts from tectonised mudstones before. I also doubt that gas would be viable financially. Fracking is very expensive and the amount of gas obtained would have to pay back those costs (plus any refracking needed) and for the disposal of any returned liquids. Those liquids, as opponents of fracking enjoyed telling everyone, contain potent carcinogens.

As for the earthquakes, yes to date they have been minor but the problem was that they were steadily increasing in magnitude. The fear was that, if this trend continued, eventually a structure-damaging event might well occur. The government stepped in with a moratorium. It may be that Quadrilla were even thankful for this intervention (I have no evidence for this) but even they must have been getting anxious that they might be liable if their activities caused significant structural damage, injury or even loss of life. If you were thinking that just injecting liquid under pressure couldn’t cause significant earthquakes, I draw your attention to a Federal waste disposal site outside of Denver, Colorado, where earthquakes of magnitude 6 have been regularly induced.

Might I suggest that, if you do read up on this topic, that you do it with your sceptical hat pulled well on. pro- and anti- fracking material is equally and massively biased.

LikeLike

“Fracking firm Cuadrilla to permanently abandon UK shale gas sites

Firm sets out plan to seal two shale gas wells in Lancashire two years after government shutdown order”

https://www.theguardian.com/environment/2022/feb/10/fracking-firm-cuadrilla-to-permanently-abandon-controversial-uk-sites

“The owner of the shale fracking company Cuadrilla will permanently plug and abandon its two shale wells in Lancashire, drawing a line on Britain’s failed fracking industry.

Cuadrilla set out plans to permanently seal the two shale gas wells drilled at the Preston New Road Lancashire shale exploration site a little over two years after the government brought an end to fracking in England.

Francis Egan, the chief executive of Cuadrilla, said the government’s oil and gas regulator had ordered the “ridiculous” shutdown of the wells in the northern Bowland Shale gas formation despite Europe’s gas supply crisis.

“At a time when the UK is spending billions of pounds annually importing gas from all corners of the globe, and gas prices for hard-pressed UK households are rocketing, the UK government has chosen this moment to ask us to plug and abandon the only two viable shale gas wells in Britain,” Egan said….”.

Alan K – I post the above with a view to asking for your comments. I’m not arguing with you – I can’t, I don’t know enough about it! However, I’d be interested in your take on Cuadrilla’s chief exec’s claim that they are 2 viable shale gas wells.

LikeLike

JIT – have you read – https://www.dailymail.co.uk/debate/article-10503839/ANDREW-NEIL-madness-ignore-answer-energy-crisis-thats-lying-feet.html?mc_cid=3d13179627&mc_eid=4961da7cb1

not sure Neil knows to much about the problems Alan highlights, but worth a read.

LikeLike

ps – should give a h/t to somebody for the link – but can’t remember who !!!

LikeLike

pps – may have been – https://notalotofpeopleknowthat.wordpress.com/2022/02/12/andrew-neil-its-madness-to-ignore-the-answer-to-the-energy-crisis-thats-lying-under-our-feet/

LikeLike

Wondered how much was spent so went to the website – “Cuadrilla has spent hundreds of millions of pounds establishing the viability of the Bowland Shale as a high-quality gas deposit – …Emissions from importing gas are far higher than those from home-produced shale gas. I don’t think that this has been properly thought through.”

“https://cuadrillaresources.uk/government-orders-plugging-and-abandonment-of-britains-shale-wells-in-midst-of-energy-crisis/

LikeLike

Df. “Cuadrilla has spent hundreds of millions of pounds establishing the viability of the Bowland Shale as a high-quality gas deposit “.

I really don’t know anywhere near enough to make definitive comments about shale gas because although I have read semi-widely I don’t have the first hand knowledge of working with geologists who explored for shale gas. In particular I do not understand how the enormous costs of fracking can be offset by selling the produced gas. As a rule of thumb, conventional gas wells are not fracked, you never recoup your costs.

More importantly the viability of a fracked Bowland Shale gas well cannot be established until it is placed under production and enough gas is produced to pay back the drilling and completion costs. It is not uncommon to find that a seemingly viable well suddenly fails and has to be refracked or abandoned. Until there are production wells the Bowland Shale it is not a proven gas reservoir (but presumably has huge untapped potential).

I have read that Shale deposits in Poland have greater promise than those in the U.K., yet still do not produce.

Read Quadrilla published reports with much NaCl.

LikeLiked by 1 person

“Bring back fracking” features on the front page of today’s Telegraph too, with Lord Frost and 30 MPs writing to the PM, who says “Nyet!”

(So far.)

With all the coverage these (for now) maverick views are getting, many more folk will at least be aware now that the non-exploitation of shale is an active decision, not a default. In other words, the shale might not be as good as its promoters think, but the refusal has nothing to do with that.

LikeLiked by 1 person

Alan,

You can always tell when you are dealing with an expert because they are usually quite anxious to declare their limits of knowledge. That’s why we are so lucky to have you on board.

LikeLike

Article by The Bish on the OTT regulations for UK fracking in the Spectator today:

https://www.spectator.co.uk/article/how-britain-s-fracking-industry-was-regulated-into-irrelevance

“New rules were put in place that made operators stop work if they caused even a tiny earth tremor. The so-called ‘red light’ level was set so low – far below anything detectable – it was said that if you wanted a long weekend, all you had to do was drop a spanner on the drilling pad on Thursday evening.

The government was making it abundantly clear that they had decided they could do without onshore gas (or at least the political flak that came with it) a message that was reinforced by the fact that no other industry that caused earth tremors had to operate under the same strictures…”

“…the only way out of the crisis in the next few years is to drive down the cost of gas. An increase in the domestic supply would help, because it would enable us to replace some of our more expensive imports, and in particular liquefied natural gas.

This being the case, how can we explain the decision to seal the wells up? In fact, it makes sense if you take a look at the OGA’s remit. In this extraordinary document, you will find no mention of any duty to ensure that operators aren’t cutting corners. There is nothing about making sure that they deliver for consumers, nor even anything about national energy security (another issue of pressing urgency, given Mr Putin’s machinations). Instead, the role that government has given it revolves entirely around delivering Net Zero. Put bluntly, the OGA is more about closing the industry down than regulating it…”

OGA = Oil and Gas Authority.

LikeLiked by 1 person

Paul Homewood has posted today, a letter from Cuadrilla’s CEO which gives some more information about the wells in the Bowland shale.

https://notalotofpeopleknowthat.wordpress.com/2022/02/20/francis-egan-jeremy-warner-is-wrong-on-shale-gas/

LikeLiked by 1 person